Why Does the Mayor's Budget Use Outdated, Inaccurate Estimates for JumpStart Spending?

Unlike the rest of the budget, spending on affordable housing, green jobs, and small businesses from the payroll tax is based on lowballed revenue estimates from 2020.

By Erica C. Barnett

Mayor Bruce Harrell's proposed 2025-2026 budget uses the majority of revenues from the JumpStart payroll tax—about $287 million out of $563 million total—for purposes that have nothing to do with the adopted spending plan for the tax, which is codified in local law.

The council and mayor approved the tax on the city's biggest companies as a way to fund affordable housing, green jobs, and small business assistance for communities most affected by the rising cost of housing in Seattle. Harrell's plan leaves just $233 million for the original JumpStart spending categories; another $43 million would go into a reserve fund.

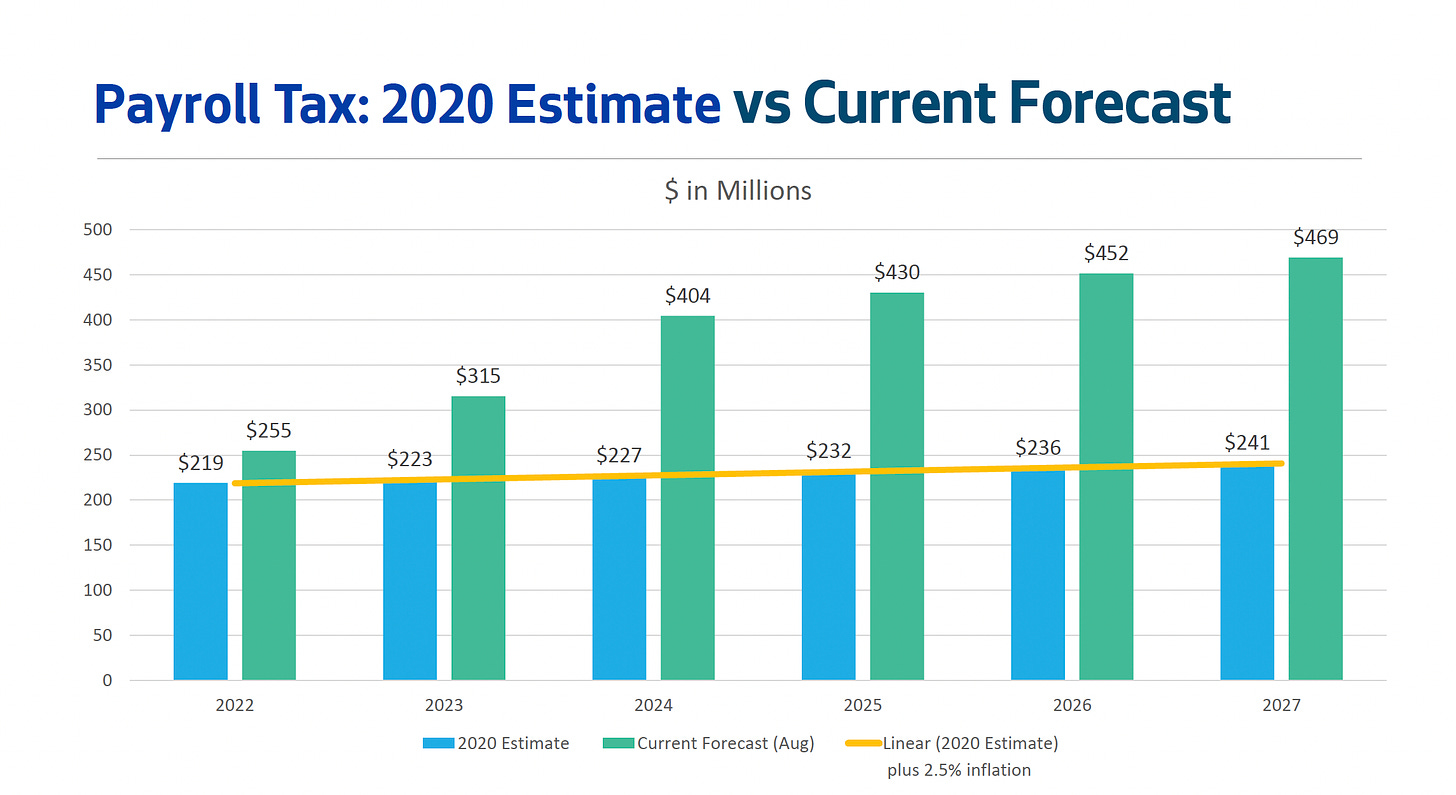

The budget uses a lowball 2020 estimate as the baseline for JumpStart spending for both past and future budgets, then inflates it by an annual 2.5 percent—far lower than the actual rate of inflation, much less the increase in construction and labor costs, which have risen faster than consumer prices. As a result, JumpStart spending into the future isn't just based on out-of-date projections that the city knew were far too low after the first year the tax was collected, it increases much more slowly than the price of the things it was earmarked to fund, eroding in value every year.

Put another way: Under Harrell's plan, as long as JumpStart revenues continue to increase, more and more of its revenues will be siphoned off for stuff like police, fire, and transportation, even as the value of the money set aside for the tax's original spending categories declines.

PubliCola asked the mayor's office why they used old, inaccurate projections as the baseline for JumpStart spending, given that the city generally updates its budget projections regularly based on real numbers, not fictitious ones.

A spokesperson for Harrell said that using the numbers from the "initial forecasts demonstrates that we are maintaining funding levels for key priorities near the rate that they were expected at the time the tax was passed. The more than doubling of revenues in the last five years makes clear revenues are higher than expected, with additional dollars that can support the general fund as the tax has been used every year since it was passed."

Although it's true that the tax has been used this way every year, the law effectively requires the city to adopt new legislation allowing a transfer in any year they want to make such a transfer. For the 2023 and 2024 budgets, the council capped this transfer at $71 and $84 million, respectively—a fraction of the transfer Harrell is proposing this year.

Harrell's spokesperson said the city needed to have access to the JumpStart funds, also known as the Payroll Expense Tax (PET), because the city's long-term revenue forecast remains unclear.

"We don’t know what the future of PET or General Fund will look like, which is why it is important that we have this flexibility as well as the reserve created in the Mayor’s proposal to address any future volatility in the funding source," the spokesperson said. "That flexibility is important to best match our resources with the current needs of the city as the economy continues to recover from the historically adverse effects of the worldwide pandemic and as our revenue sources adjust to these changing conditions."

This is different than the way the city approaches other parts of its budget; in fact, Harrell's budget plan notes right up front that the budget "relies upon solid forecasts incorporating items which are constantly changing," and every departmental budget includes "Citywide Adjustments for Standard Cost Changes" to reflect the true cost of inflation.

Tapping payroll tax revenues for the indefinite future is also a different approach than what Harrell proposed in his 2023-2024 budget, when he endorsed exploring revenue stabilization options, such as new taxes, to address the city's structural budget gap.

"The way our state and local governments finance services to support community needs is often structured in a manner that puts a disproportionate financial burden on those least able to afford it," the mayor's 2023-2024 budget said. "In the wake of rising inflation and dwindling proceeds from local funding sources like cable television and commercial parking taxes, there is an opportunity to re-envision the way the City funds its service delivery and operations."

Acting in accordance with Harrell's previous budget, the city set up a revenue stabilization work group to come up with new sources of revenue to address the problems that budget identified; in mid-2023, the group recommended three options: Increasing the size or scope of the payroll tax; a local capital gains tax; and tax on tax on businesses whose CEOs make significantly more than the average worker.

Business groups immediately trashed all three options, and six months later, Harrell issued what amounted to a no-new-taxes pledge in his state of the city speech.

You bring up an interesting point. Hope this story gets developed.